- Bitcoin Apparent Demand turns negative as miners and holders sell, signaling potential market weakness.

- June sees flat Bitcoin prices, July shows moderate gains, while volatility is expected in August and September.

- Historical trends suggest that Bitcoin’s drops in August and September offer buying opportunities before the year-end rally.

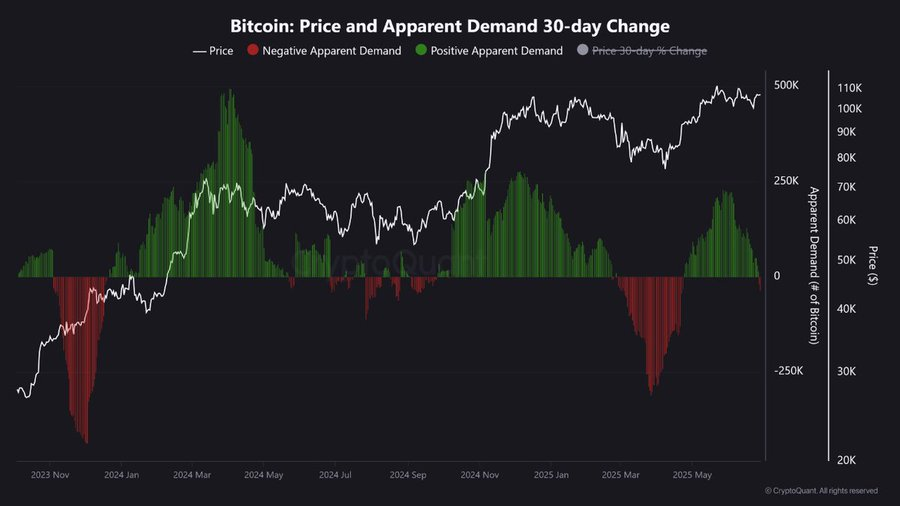

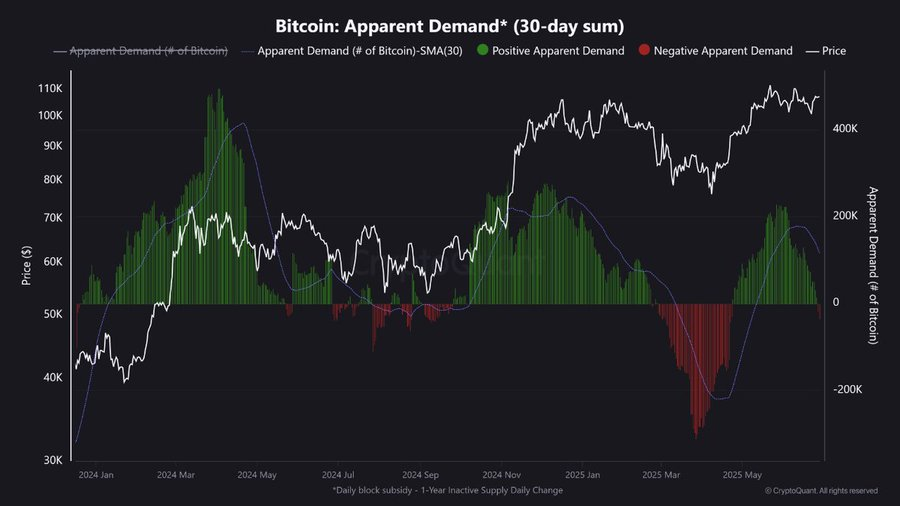

The Bitcoin market has recently experienced a weakening. A vital market indicator, Apparent Demand, has now become negative. This indicates that the number of Bitcoins being sold is outpacing the number being purchased. Miners and long-term holders are selling coins. There are no new purchasers in the market. Such a change has heightened the concerns of investors.

Source: X

Crypto Patel highlighted that this adverse trend is an alarm bell. It is an indication of potential market weakness. Although the price of Bitcoin might seem steady, the demand is experiencing a setback. This could result in a significant price reduction. As history indicates, when the demand becomes negative, the outcome tends to be troublesome.

Source: X

Bitcoin (BTC) is trading at $107,469, marking a 0.22% increase over the past day. The trading volume stands at $33.33 billion, showing an 8.74% uptick over the last week.

Source: CoinMarketCap

Also Read: Bitcoin Fights Authoritarian Control, Says HRF Executive

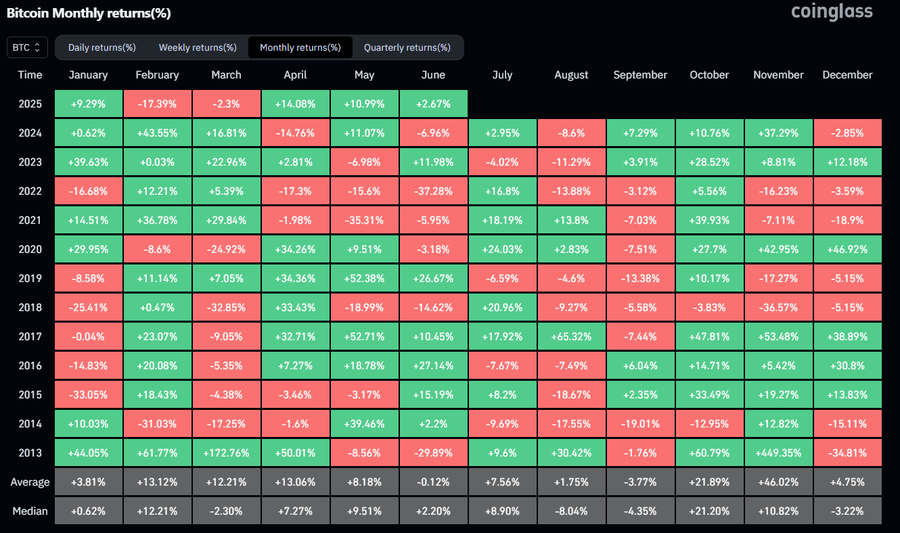

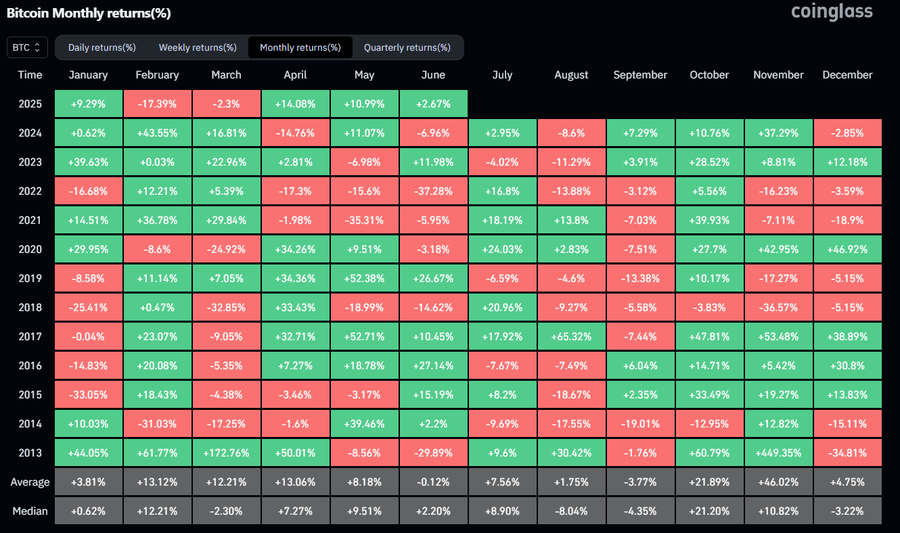

Bitcoin Seasonal Trends

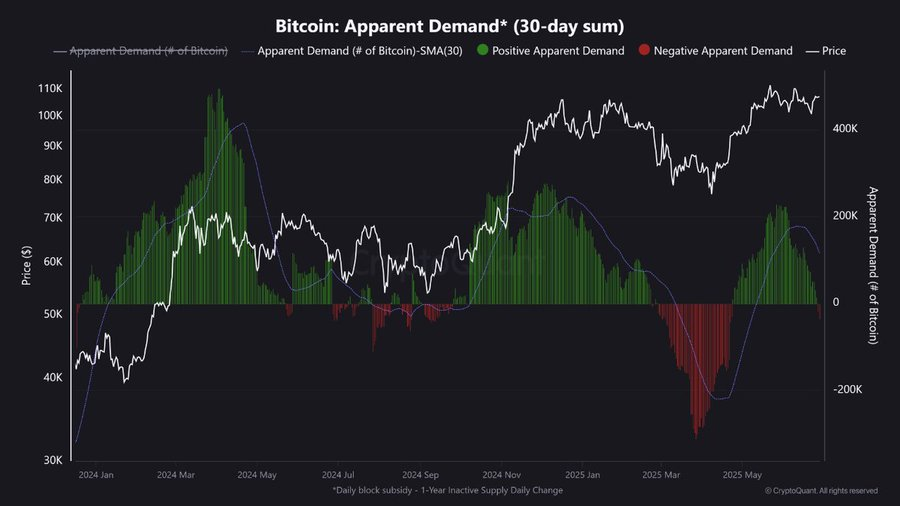

Daan Crypto Trades has revealed that June is the slowest month for Bitcoin. The trend has persisted this year, with the price of Bitcoin trading mostly sideways. There is a relatively flat price movement. Analysts predict that the month of June will end with a slight shift in the price of BTC.

Bitcoin experienced a positive trend in July. Nevertheless, major price booms are not to be expected. July is more likely to provide moderate profits. Investors can also experience a slight increase, but explosive growth is uncommon. The actual volatility of BTC is mostly felt in August and September.

Source: X

In August and September, negative trends in the price of BTC have been characteristic. Market movements are usually very high during these months. These drops, however, have offered opportunities to buy too. Investors keeping a close eye on the market will usually purchase before the year-end rally in BTC. The fluctuations in these months can be viewed as a potential for long-term growth.

Navigating Market Uncertainty

Knowledge about these seasonal patterns can help investors navigate the market more effectively. Investors will be better equipped to understand such trends by acknowledging these cycles. It prevents overreaction to small-scale price changes.

There is uncertainty emerging about the near-term future of BTC. The future indicators are pointing to a possible decline, whereas the past developments point to a rebound. BTC has previously experienced a slump and recovered. It remains unclear whether this time will be different. Investors should be cautious and expect the market to fluctuate between upward and downward movements.

The markets are unpredictable, and learning the patterns and trends can help make deliberate choices. The fact that BTC will crash or bounce back depends on various factors. The investors will watch, for the moment, and see what the next few months bring. The future will determine whether the cryptocurrency market will undergo a shake-up or rise to greater heights.

Also Read: Trump’s Strategic Bitcoin Bet Sparks $2.3 Billion Crypto Treasury Frenzy