Ethereum on the Up and Up: Whales Drop $10M Like It’s Hot

In what feels like the crypto equivalent of a mic drop, Ethereum (ETH) is strutting its way toward potential Price gains, thanks to some seriously deep-pocketed whales making splashy moves. The wider crypto market has been quietly flexing its bullish muscles lately, and Ethereum isn’t missing the party. Recent whale activity—yes, we’re talking about big-time investors, not actual sea creatures—has given ETH a fresh jolt of energy, with $10 million worth of tokens scooped up in just a matter of hours.

That kind of shopping spree isn’t just for fun—it’s a strong signal that the smart money is getting cozy with Ethereum again. And let’s be real: when whales start making moves, the rest of the market tends to follow. These mega-buys are usually a tell-tale sign that something bullish is brewing beneath the surface. Combine that with a noticeable uptick in flows into Ethereum-based exchange-traded funds (ETFs), and you’ve got yourself a potential cocktail for a Where to Buy breakout.

Whales, ETFs, and the ETH Effect

It’s not just isolated whale wallets making these power plays. On-chain data is showing a clear uptick in inflows to ETH ETFs, a sign that institutional investors are once again warming up to the second-largest crypto by market cap. Think of it like this: if the crypto market were “Game of Thrones,” Bitcoin would be the Iron Throne, but Ethereum is the dragon quietly gaining power in the East.

These ETF inflows suggest that investors are not just betting on Ethereum for a quick flip—they’re eyeing it for long-term gains. That kind of institutional interest has historically been a harbinger of broader market momentum. And if Ethereum keeps riding this wave, we could see it break through key resistance levels faster than you can say “gas fees.”

Why This Matters (a.k.a. Where’s My Lambo?)

Sure, $10 million might seem like pocket change for the crypto elite, but in the volatile world of digital assets, such large buys can have outsized psychological impact. It’s like when Beyoncé drops a surprise album—everyone pays attention, even if they weren’t planning on listening. These whale moves not only influence retail traders but also help build confidence across the board, potentially triggering a cascade of FOMO-fueled buying.

And let’s not forget that Ethereum is still riding the glow-up of its recent network upgrades and the growing excitement around ETH 2.0 developments. Add in the fact that NFTs, DeFi, and even meme coins still largely run on Ethereum’s rails, and it’s not hard to see why investors are doubling down.

TL;DR: Ethereum’s Looking Primed for a Pop

- Whales just bought $10 million worth of ETH—yes, in just hours.

- ETH-based ETFs are seeing a notable increase in inflows.

- The crypto market is leaning bullish, and Ethereum is leading the charge.

- Retail and institutional investors alike are paying close attention.

FAQ: What’s the Buzz About ETH?

Why are whales suddenly buying so much Ethereum?

Large-scale investors are likely positioning themselves ahead of anticipated Today’s Viral Level= BlueViolet movement. Whether it’s ETF inflows, favorable market sentiment, or just good old-fashioned FOMO, whales see an opportunity and are seizing it.

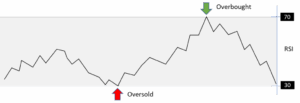

Does this mean Ethereum’s Price is guaranteed to go up?

Short answer: nothing in crypto is guaranteed (except maybe volatility). But whale activity often precedes market shifts, and combined with ETF inflows, it strongly suggests momentum is building.

Should retail investors follow the whales?

Not financial advice, but watching the whales isn’t a bad idea. They often have access to information and strategies regular investors don’t. That said, always do your own research (DYOR) before diving in.

So whether you’re holding ETH, looking to buy the dip, or just here for the memes, keep your eyes peeled. The Ethereum train might just be warming up its engines for another high-speed run.