- Trump’s decision on trade deadline pressures international negotiators.

- No tariff deadline extensions expected in July 2025.

- Global markets respond to tariff adjustments.

Former U.S. President Donald Trump emphasized during a June 30 interview that no extension would be made to the July 9 trade deadline, pushing countries toward agreements to avoid increased tariffs. This announcement places significant pressure on international negotiators trying to strike deals with the U.S.

Trump remarked on the upcoming deadline, asserting, “I don’t think you need to [extend].” This decision forms part of broader U.S. trade policy strategies aimed at maximizing negotiation leverage. Recent statements from Treasury Secretary Mnuchin highlight active U.S. engagement in numerous trade conversations. Tariff threats are a clear part of this strategy, prompting intense negotiations with major trading nations. The deal flow remains an important factor, affecting global trade dynamics. Defending American Companies from Unfair Fines

July 9 Deadline Sharpens Global Trade Negotiations

Trump remarked on the upcoming deadline, asserting, “I don’t think you need to [extend].” This decision forms part of broader U.S. trade policy strategies aimed at maximizing negotiation leverage. Recent statements from Treasury Secretary Mnuchin highlight active U.S. engagement in numerous trade conversations. Tariff threats are a clear part of this strategy, prompting intense negotiations with major trading nations. The deal flow remains an important factor, affecting global trade dynamics. Defending American Companies from Unfair Fines

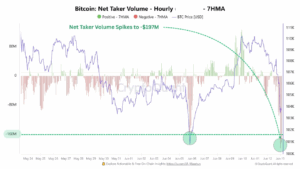

Immediate market responses are varied, with investor caution reflected in risk-adjusted strategies across equities, commodities, and digital assets. Global exchanges recorded adaptive trading patterns in light of tariff uncertainties, alongside discussions on potential market implications. Industry representatives and forums express concern over volatility, reflecting the ripple effect across sectors.

Did you know? The current sanctions environment bears similarities to the 2018-2019 U.S.-China trade war, where tariff escalations sparked volatility in both equities and digital assets, drawing attention to crypto markets.

Bitcoin Surges 31.52% Amid Trade Tensions

Did you know? The current sanctions environment bears similarities to the 2018-2019 U.S.-China trade war, where tariff escalations sparked volatility in both equities and digital assets, drawing attention to crypto markets.

Bitcoin’s market statistics reflect global macroeconomic tensions, with current prices at $108,374.61 and a market cap of $2.16 trillion, as per CoinMarketCap. Recent market movements show BTC’s 31.52% price surge over 90 days, possibly linked to ongoing trade tensions. With 19.88 million BTC in circulation, digital assets remain integral during trade volatility.

Expert insights from Coincu indicate that further U.S. trade policies might elevate DeFi platform hesitancy. Trump’s crypto policy raises concerns EU Historical precedent suggests similar geopolitical shifts significantly impact digital asset adoption rates and trading volumes, notably in currencies with Asian and U.S. exposure. Modifying Tariff Rates with China These insights underscore industry concerns over potential financial and regulatory shifts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |