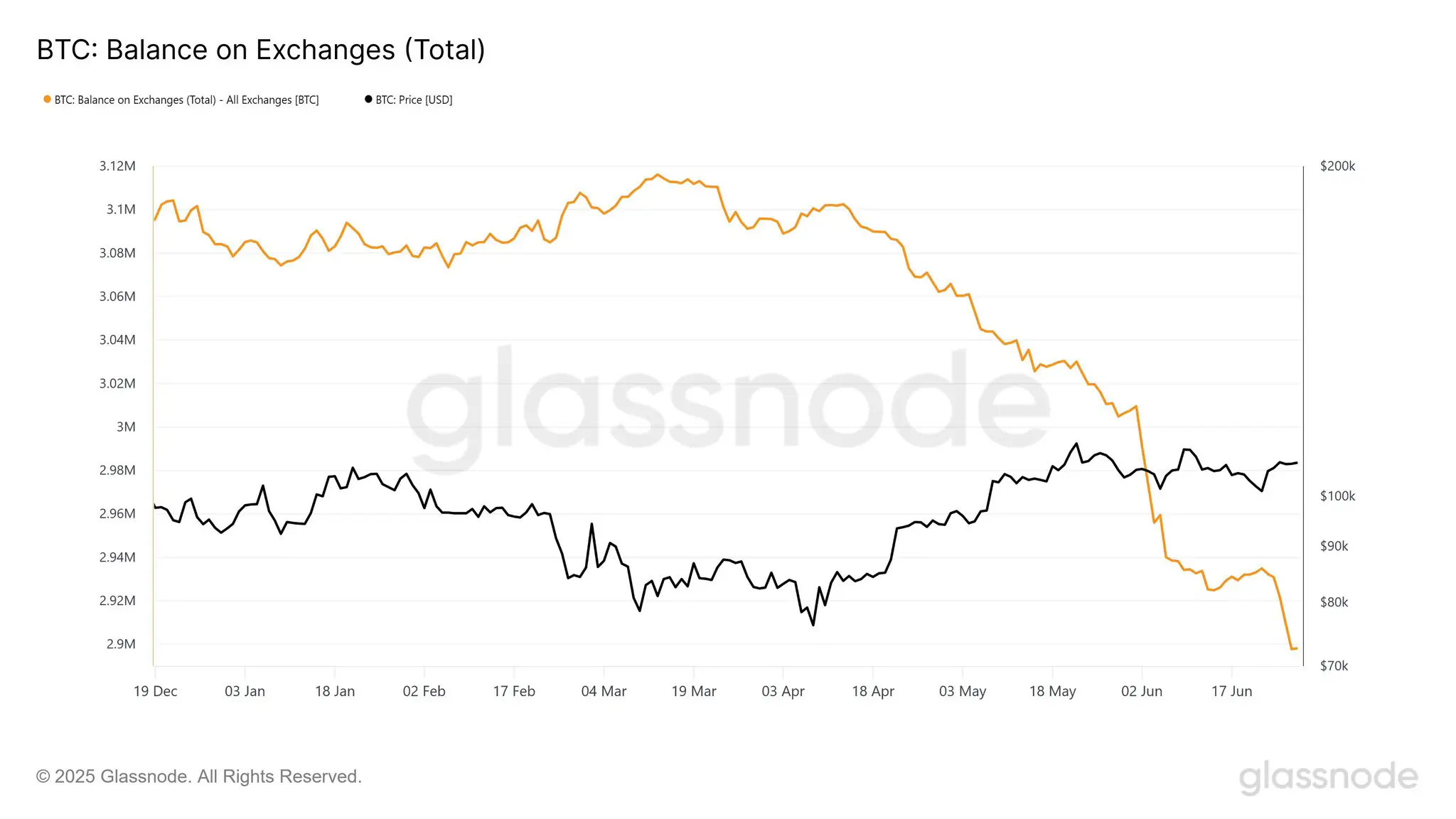

Bitcoin holdings on centralized exchanges have dropped below 2.9 million BTC for the first time since 2019, according to on-chain data from Glassnode — a sign that investors may be gearing up for a supply squeeze.

The drop reflects a broader trend that’s been accelerating since April, with over 150,000 BTC leaving exchanges and heading to cold storage. The last time exchange balances were this low, Bitcoin saw a massive rally, gaining more than 230% in the following years.

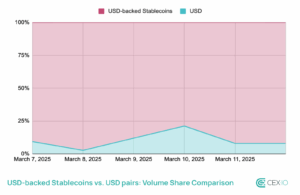

Traders often view a decline in exchange balances as a bullish signal, indicating strong conviction and reduced near-term sell pressure. If demand picks up while supply remains tight, it can trigger a sharp price move — a scenario often referred to as a supply shock.

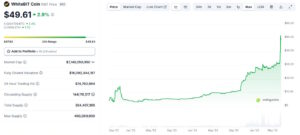

Fueling the exodus are institutions and ETFs. In just three months, corporate buyers and treasury firms have pulled over 100,000 BTC from exchanges. Michael Saylor’s Strategy is reportedly preparing another major acquisition, joining names like ProCap Financial and GameStop in the accumulation trend.

Meanwhile, Bitcoin ETFs are attracting massive inflows, with over 800,000 BTC now held in ETF custody wallets, contributing further to the supply drain.

Despite the bullish indicators, not everyone agrees. Financial author Robert Kiyosaki has warned of a possible Bitcoin price collapse in July, highlighting the split in market sentiment.

As BTC hovers near key levels, all eyes are now on whether this shrinking supply will light the fuse for the next rally — or if a surprise correction lies ahead.