Content

Introduction: The Invisible Battlefield Behind Every Blockchain Transaction

Using the blockchain may seem simple: you swap tokens on a DEX, mint a trending NFT, click confirm, and wait. But behind that click lies a hidden, high-stakes battle over transaction order that most users never see.

This battle is called MEV, or Maximal Extractable Value. It refers to the profit that block producers, like miners or validators, can extract by reordering, inserting, or delaying transactions. MEV isn’t a bug, but rather a gray area within blockchain design. It’s technically legal, but extremely disadvantageous to regular users.

According to ZENMEV, the scale of MEV on global blockchains has skyrocketed from under $100 million in 2020 to over $1.1 billion by the end of 2024, creating a thriving gray market on-chain. Ethereum remains the biggest battlefield, where sandwich attacks alone account for roughly 66% of all MEV activity. Most users have already become prey to MEV bots without even knowing it.

When your transactions aren’t protected, you’re likely paying a hidden cost. You might end up buying at inflated rates, selling for less than expected, or missing the perfect trading window, all because someone else exploited your transaction for profit.

The good news is that wallets are starting to take MEV seriously. CoolWallet is one of the first to offer a built-in MEV Protection feature, designed to shield users from hidden on-chain threats. In this article, we’ll explain what MEV is, why it matters, and how the blockchain community and wallet developers are working together to build smarter, safer ways to transact.

What Is MEV

MEV (Maximal Extractable Value) refers to the profits that blockchain participants such as miners, validators, and MEV searchers can gain by manipulating transaction order, inserting their own transactions, or excluding others entirely.

This behavior originates from a core feature of blockchain architecture. Before being added to a block, transactions are placed in a public queue called the mempool, where anyone can view them. Although the mempool is designed to promote transparency and openness, it also creates an opportunity for those with advanced tools and resources to deploy bots that monitor and exploit these pending transactions. This is especially common in DeFi (decentralized finance).

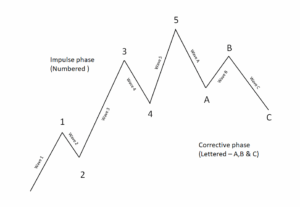

Some MEV tactics, such as arbitrage, can enhance market efficiency. However, many others can increase slippage or cause users to miss out on profitable trades. MEV typically falls into the following categories:

Arbitrage

Arbitrage is one of the earliest and simplest forms of MEV. Participants spot price differences between decentralized exchanges like Uniswap and Sushiswap, buying low on one and selling high on another within the same block to earn risk-free profit. While this is considered a form of MEV, it can benefit the market by aligning prices and improving overall liquidity.

Front-running

MEV actors watch the mempool and spot a user about to place a large buy order. They quickly jump in first, buying the token at a lower price. When the user’s trade goes through and drives the price up, the MEV actor sells at a profit. The user unknowingly ends up paying more than expected.

Back-running

This happens right after a trade that changes a token’s price. MEV actors follow closely behind, placing their own transaction to take advantage of the price shift. For example, they might buy a token that just dropped in price or trigger a liquidation to collect leftover value. It’s a silent way to profit from other users’ trades.

Sandwich Attack

This is one of the most harmful types of MEV. When a user is about to place a large token trade, MEV actors launch a three-part strategy:

-

First, they buy the token just before the user’s trade to push the price up

-

The user’s trade then goes through at a worse rate because of slippage

-

Finally, they sell their tokens right after at the higher price to lock in profit

The user ends up overpaying and absorbing the slippage, while the attacker walks away with the gains. Sandwich attacks are especially common on AMM-based DEXs like Uniswap and are particularly damaging for large trades or when slippage tolerance is high. This attack is essentially front-running plus back-running, a textbook example of MEV exploitation targeting everyday users.

Liquidation Arbitrage

This strategy often appears in lending protocols. When a user’s collateral drops below the liquidation threshold, MEV actors use fast bots to race for the liquidation and claim a fixed reward (usually around 5 to 10 %). These rewards are meant to keep the protocol stable, but in practice, they mostly benefit validators and professional searchers. For the user being liquidated, there’s no upside but only loss.

MEV is now widespread across Ethereum, BNB Chain, Polygon, and other major networks. While not malicious in the conventional sense, these tactics quietly extract value from users. Without realizing it, they may end up buying at higher prices, selling for less, or missing optimal trade opportunities altogether.

How MEV Affects Users: Your Assets Are Being Quietly Drained

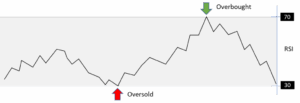

For most blockchain users, MEV is invisible, but its impact is very real. Every transaction you send first enters the mempool, a public queue where it can be seen before being confirmed on-chain. Without protection, these transactions can be observed, re-ordered, or exploited by bots and validators seeking profit.

One of the most common effects is increased slippage. You might expect to buy a token for 100 dollars, but due to a sandwich attack, you end up paying 105. Or you plan to sell at 2,000, only to settle for 1,950. These small differences may seem minor, but over time, they can lead to significant losses for active traders and DeFi users.

In more serious cases, your transaction might fail or be delayed. MEV searchers often pay higher gas fees to cut in line, causing your carefully planned trade, arbitrage, or liquidation to miss its window. For time-sensitive strategies, this adds a layer of risk that can be hard to predict or control.

The biggest concern is that most users never notice it happening. What appears to be normal price fluctuation may actually be the result of bots taking advantage of your transaction.

This is why MEV protection should not be seen as an advanced feature for power users. It is becoming an essential safeguard for anyone who transacts on-chain. Protecting your trades helps ensure they are executed under fair and reliable conditions.

MEV Hiding: Stay Invisible Before Hitting the Chain

MEV Hiding is based on a simple principle: if others cannot see your transaction before it gets included in a block, they cannot exploit it. This strategy focuses on protecting transaction privacy by hiding the content and order of transactions before they are finalized, blocking bots and validators from running profitable front-running strategies. The key tool behind this approach is the private mempool.

On most public blockchains, submitted transactions enter a mempool and are broadcast to all network nodes. While this increases transparency, it also gives MEV searchers the chance to monitor the pool in real time, insert their own trades, or reorder transactions to their advantage. Private mempools avoid public broadcasting by sending transactions directly to selected block builders. This prevents bots from detecting and exploiting unconfirmed trades.

Private transaction pools have become essential for high-frequency traders and DeFi users. One of the most well-known examples is Flashbots Protect, which has safeguarded over 43 billion dollars in transaction volume. It is now a popular choice for defending against sandwich attacks and other forms of MEV exploitation.

MEV Minimisation: Leave No Room for Bots to Profit

MEV minimisation is based on a simple principle: design protocols in a way that removes opportunities for MEV, leaving nothing for bots to exploit.

A leading example is CowSwap’s batch auction mechanism. Instead of processing each transaction individually, the system gathers all transactions within a short time window and executes them together at a single clearing price. This ensures that every user gets the same execution conditions, eliminating the chance for bots to profit from reordering, front-running, or sandwiching trades.

This model stands in contrast to traditional first-come, first-served systems. It functions more like synchronized clearing, which reduces the incentive for speed and helps create a more level playing field. The trade-off is that transactions may experience slight delays, which may not be ideal for time-sensitive strategies.

Despite this, CowSwap has already handled over $10 billion in trading volume, proving that this type of design not only works in practice but is becoming a trusted defense against MEV in the DeFi space.

MEV Exploitation: If You Can’t Stop It, Regulate It

The idea behind MEV exploitation is simple: if arbitrage can’t be eliminated, it should be managed through fair and transparent systems. By turning transaction ordering and block space into open and competitive resources, protocols can reduce behind-the-scenes manipulation. This approach allows profits to be shared with validators, network participants, and community DAOs, helping improve fairness and system stability.

For example, Jito on Solana uses off-chain auctions that run every 200 milliseconds. The highest bidder earns the right to include their transactions, and the resulting tip is distributed between validators and the Jito DAO. This creates a sustainable revenue cycle, where MEV activity becomes a known and governed process rather than a hidden race.

By shifting MEV extraction from private advantage to public governance, this approach turns what was once a zero-sum game into a shared opportunity. It improves the efficiency of transaction ordering, ensures rewards are fairly distributed, and brings greater predictability and transparency to the blockchain ecosystem.

MEV Recycling: Turning Hidden Costs into Community Reward

The core idea of MEV Recycling is to turn unavoidable MEV extraction into a public good for the blockchain ecosystem. Instead of letting profits concentrate in the hands of a few validators or searchers, this approach uses structured mechanisms to redistribute those gains transparently to DAOs, token holders, and network participants. The goal is to build a predictable, sustainable reward system that benefits everyone involved.

Take Arbitrum’s Timeboost as an example. This mechanism auctions off 200-millisecond “express lane” slots every minute using a sealed second-price bidding system. Similar to a VIP checkout line, the highest bidder gets prioritized transaction placement. Instead of competing through gas fees, MEV searchers place strategic bids based on short-term market trends to gain an advantage in transaction ordering.

This setup transforms high-speed, exploit-driven MEV tactics into a more controlled and rule-based form of competition. Users of the express lane are better protected from sandwich attacks and similar exploits. Frequent auctions also reduce the risk of monopolies or collusion. Most importantly, Timeboost returns up to 97 percent of auction revenue to the ARB DAO, generating nearly $30 million a year in funding for community governance.

While these systems are still developing, they offer a clear direction. By turning MEV extraction into a transparent, community-governed process, MEV Recycling moves blockchain ecosystems toward a fairer and more sustainable future.

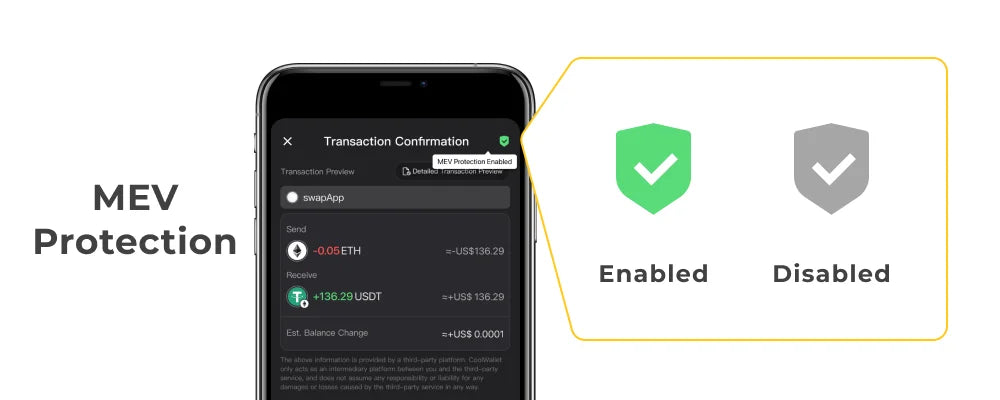

CoolWallet’s MEV Protection: Shielding Your Transactions from Exploitation

CoolWallet has partnered with Merkle to launch MEV Protection, a feature that leverages private mempool technology to enhance transaction privacy and guard against MEV attacks. By keeping your transaction details out of the public mempool, this feature prevents bots from monitoring or reordering your transactions, effectively stopping exploit tactics like sandwich attacks.

This protection is available across all CoolWallet products, including CoolWallet Pro, CoolWallet S, CoolWallet Go, and the hot wallet CoolWallet HOT.

Once enabled, your transaction data remains encrypted until it is added to a block. Only selected block builders can access the information, helping to ensure your transaction order and security stay intact.

How to Enable MEV Protection

On the transaction confirmation page in the CoolWallet App, tap the MEV Protection icon at the top right. When the shield icon turns green, it means MEV Protection is enabled. Your transaction will be sent through a private channel, reducing the risk of being targeted by MEV strategies.

⚠️ Please note: With MEV Protection turned on, your transaction enters a private mempool first. This means it won’t show up on blockchain explorers while it is pending, but it will appear as usual once it is confirmed on-chain.

Currently, MEV Protection supports Ethereum, BNB Smart Chain (BSC), and Base networks.

Conclusion

Transparency doesn’t always mean fairness. In Web3, true freedom lies in protecting yourself.

Although blockchains are designed to be open and transparent, this openness has created a gray area where transaction ordering can be exploited. MEV is a hidden battleground that quietly extracts value from every unprotected transaction.

The encouraging news is that users now have more control. From private mempools and batch auctions to structured bidding and reward-sharing systems, the blockchain community and wallet developers are working together to bring fairness back. CoolWallet’s MEV Protection is one of the tools helping make that change happen.

Understanding MEV gives you the power to defend against it. Choosing a wallet with protective features is not just about safeguarding your assets, but also about preserving the integrity and decentralization that blockchain was built for.

CoolWallet MEV Protection FAQ

Q1. What is MEV, and why should I enable MEV Protection?

MEV (Maximal Extractable Value) refers to actions by validators or bots that manipulate transaction order to make a profit. Without protection, your transaction could be front-run or sandwiched, leading to worse prices or failed trades. MEV Protection hides your transaction details to prevent such attacks and helps secure your assets.

Q2. Can I still see my transaction status on a blockchain explorer when MEV Protection is enabled?

Once enabled, your transaction is routed through a private mempool and only appears on-chain after it is confirmed. It won’t show up while pending, which is an intentional design to protect your privacy and prevent front-running.

Q3. Which networks support MEV Protection?

MEV Protection currently supports Ethereum, BNB Smart Chain (BSC), and Base.